We are an investor group who controls 9.6 per cent of GAM Holding AG.

We are convinced there is an opportunity to unlock significant value at GAM if the company can complete a successful turnaround and prioritise higher value-added activities in a more efficient corporate structure.

We are an investor group comprised of NewGAMe SA and Bruellan. NewGAMe is an investment vehicle controlled by Rock Investment, a subsidiary of NJJ Holding, the personal holding company of Xavier Niel.

Bruellan is an independent provider of global wealth management solutions, headquartered in Geneva, Switzerland.

The leadership of NewGAMe and Bruellan have significant experience of the global asset management industry as well as corporate turnarounds.

Our group has increased its stake and holds or has the right to exercise voting rights attached to around 9.6 per cent of the issued share capital of GAM Holding AG, making us one of the company’s largest shareholders. We have also notified FINMA of our intention to go above 10 per cent.

On 18 July 2023, NewGAMe published the pre-announcement of its partial cash offer for up to 28 million GAM shares. Subject to certain restrictions pertaining to the location of investors, the offer documents are available here.

NewGAMe is committed to securing the necessary financial resources to fund GAM’s operations and ensure stability for clients, employees and other stakeholders. A member of our investor group has agreed to provide GAM with a mix of short- and long-term funding up to a total of CHF 100 million.

GAM has consistently underperformed for many years.

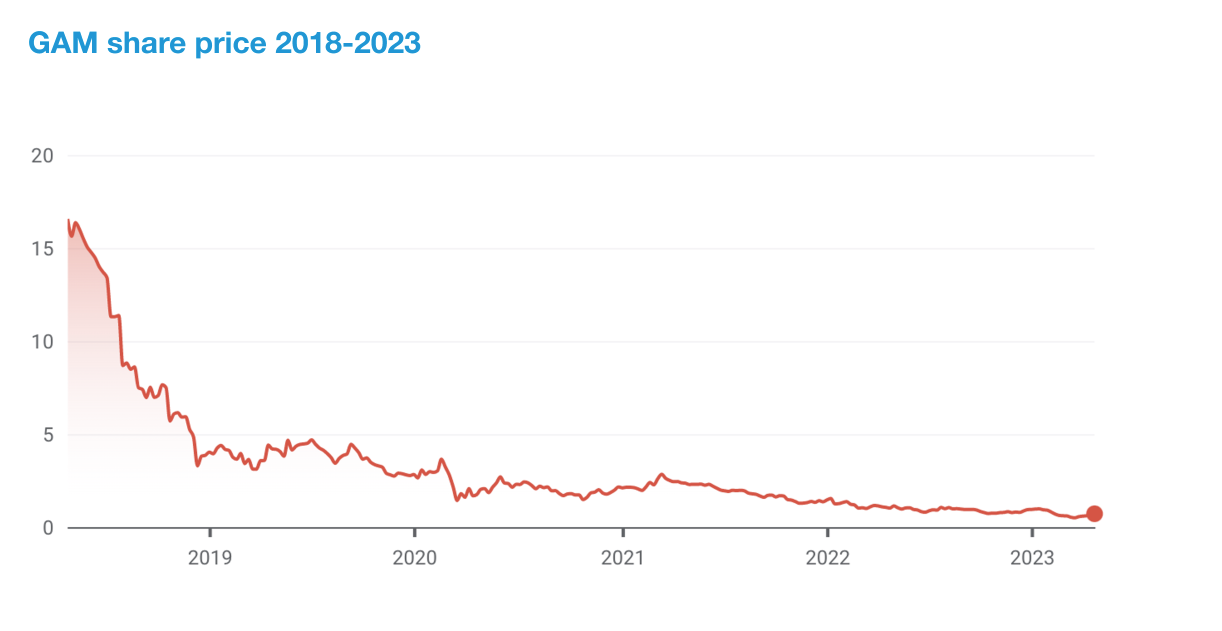

Its share price has fallen by over 95% since its 2018 peak.

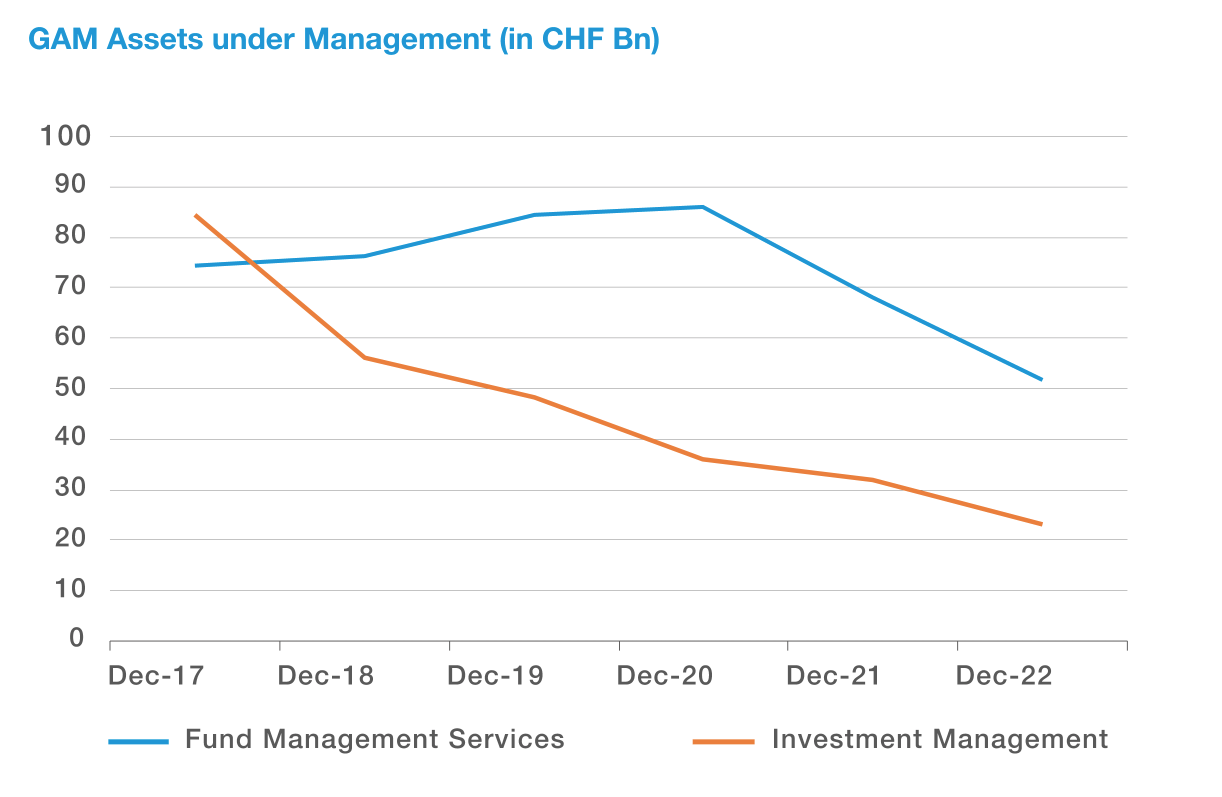

Assets under management have also fallen significantly, with investment management AUM down 73% over the past five years.

GAM has been losing money as a company and has not paid a dividend since 2018, and is the worst performing listed company in its peer group, in terms of share price performance and AuM trend.

Note: Peer group includes Vontobel, Amundi, DWS, Anima, Jupiter, Man Group, Liontrust, Ashmore, Janus Henderson, Schroeders, Gabelli, T Rowe Price, Franklin Resources, Artisan, AllianceBernstein and BlackRock

We have invested in GAM because there is an opportunity to restore GAM’s reputation as a best-in-class asset management firm.

We have requested an EGM of shareholders to revoke GAM's incumbent board and elect a new one with a clear plan to turnaround the business and to realize a very significant return on investment over the next few years. The EGM will take place on 27 September 2023.

Our proposed board of directors are all industry veterans with significant asset management and banking industry expertise, with a particular focus on key areas that must be rebuilt at the firm: hedge funds, alternatives and wealth management. All board members will have a significant investment in GAM.

Elmar Zumbuehl is the investor group’s proposed candidate for CEO of GAM.

Elmar Zumbuehl, a Swiss citizen, joined GAM in 2010 and is currently Chief Risk Officer and a member of the Group Management Board. Prior to joining GAM, he worked at Julius Baer for 10 years in a range of senior roles, including covering Julius Baer’s Asset Management business.

A presentation containing biographies of our five board candidates and more detail on our plan to unlock value at GAM can be found here.

NewGAMe's full investment thesis can be found here.

The 100 day turnaround plan can be found here.

Media enquiries

Sasha Johnson

FinElk

newgam@finelk.eu

Shareholder enquiries

Patrick J. McHugh

Okapi Partners

pmchugh@okapipartners.com

+44 20 3417 3284

+1 917 304 6636

Other enquiries

Albert Saporta

info@newgam.ch